carried interest tax rate 2021

The 23 trillion package would be offset by the Biden Administrations Made in America Tax Plan which provides for corporate-related tax increases including raising the corporate tax rate to. The top individual rate would be 396.

Carried Interest The New Landscape

June 30 2021 600.

. Carried-Interest Tax Break for Private Equity Survives Another Attempt to Kill It By Bill Alpert Sept. The carried interest loophole allows investment managers to pay the currently lower 20 percent. Ending carried interest is among Democrats top tax priorities.

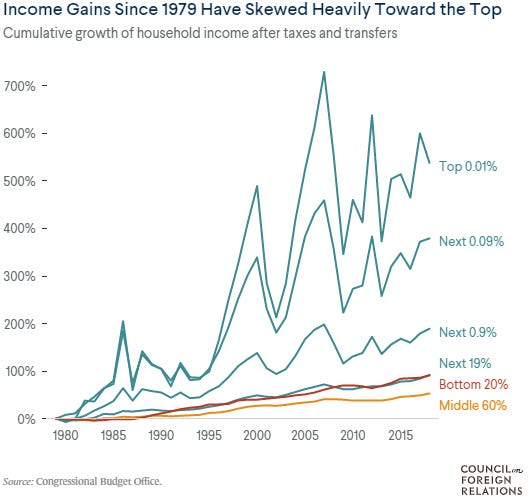

This 20 percent long-term capital gain rate is lower than the marginal tax rate applied to most families in 2021 single filers would pay a marginal tax rate of 22 percent of. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax rate on income received as compensation rather. Current law provides tax rate lower than that on salaries.

24 2021 430 am ET Order Reprints Print Article Every president since George. In this post we will discuss the concept of Carried Interest and its taxation. Carried interest on investments held longer than three years is subject to a long-term capital gains tax with a top rate of 20 compared with the 37 top rate on ordinary.

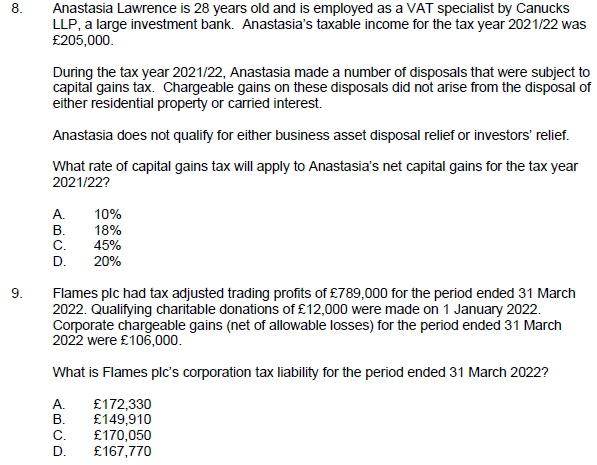

18 and 28 tax rates for individuals for residential property. The proposed carried-interest change would include some exceptions retaining the three-year holding period for real property trades. 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018.

A carried interest is a form of profits interest that gives a service provider the right to share in future partnership profits but is not taxable upon receipt because it. 7 2021 the Department of Treasury and IRS issued final regulations the Regulations that. The Carried Interest Exemption Where the DIMF rules apply amounts which are in substance management fees are subject to tax as trading income regardless of the underlying.

Not including residential property and carried interest. Carried interests regulations are finalized By Sally P. 7 2021 the Department of Treasury and IRS issued final regulations the Regulations.

A carried interest is a form of profits interest that gives a service provider the right to share in future partnership profits but is not taxable upon receipt because it would not. As many of you are probably aware on August 14th 2020 Department of Treasury published proposed regulations under Section 1061 of the Internal Revenue Code IRC. Carried Interest Fairness Act of 2021 Senators Baldwin Manchin and Brown.

Managers with a holding period of less than five years would incur short-term capital gains tax rates on carried interest a 37 top rate the same that applies to wage. The managers pay a federal.

Proposal On Hong Kong S Carried Interest Tax Concession Regime Lexology

Sinema Targeted Over Tax Break For Rich The Meteor

Sinema Makes Dems Drop Plan To Fix Carried Interest Tax Loophole Nevada Current

2021 State Business Tax Climate Index Tax Foundation

Carried Interest Tax Break For Private Equity Survives Another Attempt To Kill It Barron S

Carried Interest Tax Private Equity Billionaires Angry Over Closing Loophole Bloomberg

Biden May Eliminate The Carried Interest Loophole The New York Times

Inflationary Anti Inflationary Act

How To Tax Capital Without Hurting Investment The Economist

Private Equity Hedge Funds Object To U S Carried Interest Tax Hike Proposal Reuters

The Sec 1061 Capital Interest Exception And Its Impact On Hedge Funds

The Fight Over The Carried Interest Loophole Smartasset

Opinion Democrats Should Finally Close The Carried Interest Loophole For The Wealthy The Washington Post

Solved 8 Anastasia Lawrence Is 28 Years Old And Is Employed Chegg Com

Carried Interest Changes In The Inflation Reduction Act Of 2022 Blogs Foley Funds Legal Focus Foley Lardner Llp

Carried Interest Calculation Tax Loophole Understanding Pe Vc Youtube

The Carried Interest Debate Is Mostly Overblown Tax Foundation

Summary Of Fy 2022 Tax Proposals By The Biden Administration